The debate between cryptocurrency and traditional that is Bitcoin vs Nifty 50 equity investments has never been more relevant for Indian investors, especially following Bitcoin’s fourth halving event in April 2024. While financial advisors often recommend systematic investment plans in equity indices like Nifty 50, the explosive growth of Bitcoin post-halving has many wondering if they’re missing out on substantial returns. I decided to put both to the test with actual data spanning 18 months from the halving date, investing ₹1,000 systematically in both Bitcoin and Nifty 50. But here’s the crucial part most analyses miss: the real returns after India’s tax regulations take their share.

Understanding Bitcoin Halving and Its Impact

Bitcoin halving represents a programmed reduction in mining rewards that occurs approximately every four years, cutting the rate of new Bitcoin creation by half. The April 2024 halving reduced block rewards from 6.25 to 3.125 BTC, creating a supply shock that historically triggers significant price appreciation in subsequent months. This deflationary mechanism distinguishes Bitcoin from traditional assets and creates unique investment opportunities for those who understand the halving cycle.

Previous halving events in 2012, 2016, and 2020 each preceded substantial bull runs, with Bitcoin appreciating by multiples of its pre-halving price. The post-halving period typically sees increased institutional interest, growing scarcity, and heightened market attention that drives prices higher over 12 to 18 months following the event.

SIP in the BTC Halving Cycle

A systematic investment plan allows investors to invest a fixed amount regularly, regardless of market conditions. This strategy, known as rupee cost averaging, becomes particularly powerful during Bitcoin halving cycles when volatility intensifies. For this analysis, I tracked 37 investment points starting from April 19, 2024, just days after the halving event, through October 5, 2025, with ₹1,000 invested at each point in both Bitcoin and Nifty 50.

The timing of this comparison captures the critical post-halving accumulation phase, when smart money typically enters the market anticipating the supply squeeze effects. This 18-month window represents the early-to-mid stage of the typical post-halving bull cycle, making it especially relevant for understanding how halving events impact real investment returns.

Bitcoin SIP Performance Post-Halving Before Tax

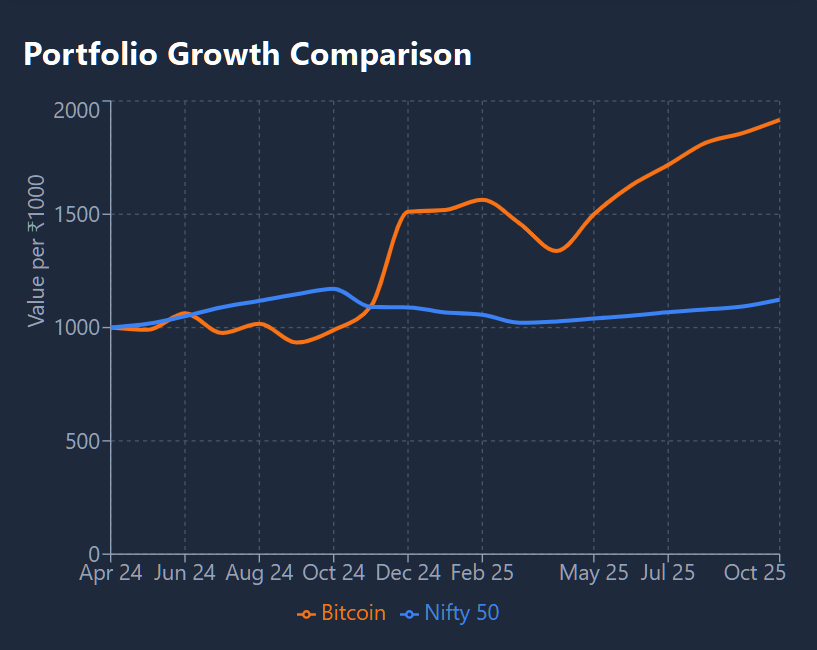

The Bitcoin investment journey post-halving revealed exactly why cryptocurrency attracts aggressive investors during these cyclical events. Starting when Bitcoin traded around $63,800 shortly after the April 2024 halving, the 37 installments of ₹1,000 each totaled ₹37,000. The cryptocurrency experienced significant volatility during this period, dropping to $59,100 in August 2024 before surging past $122,000 by October 2025, demonstrating the classic post-halving price discovery pattern.

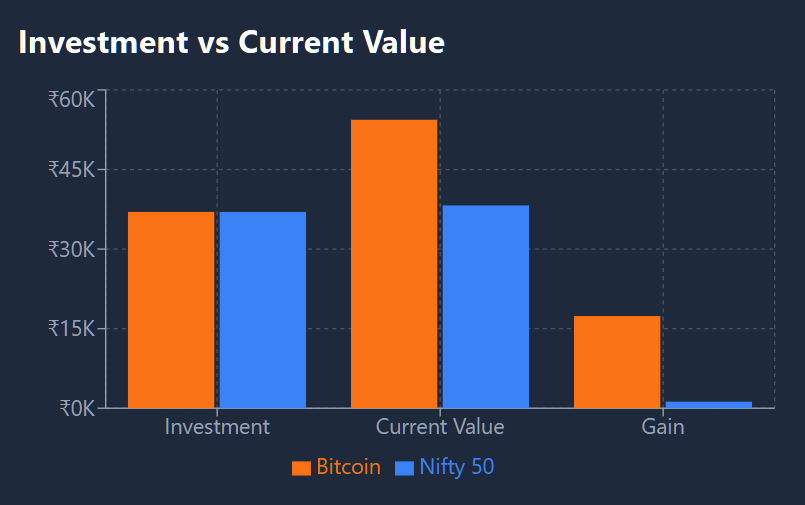

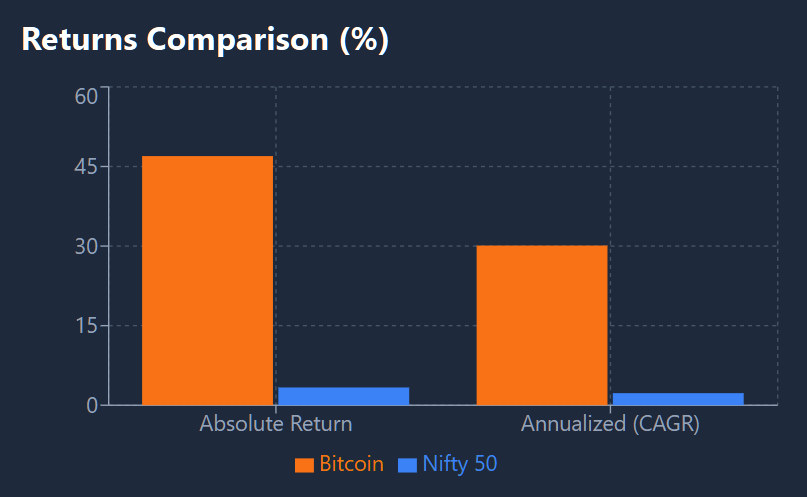

Through systematic investing during the post-halving phase, the portfolio accumulated 0.00532451 BTC units. At the current price of approximately ₹1.02 crore per Bitcoin, this translated to a portfolio value of ₹54,374. The absolute gain stood at ₹17,374, representing a return of 46.96 percent before considering tax implications, showcasing the halving cycle’s wealth creation potential.

What made this performance particularly interesting was how the SIP strategy captured Bitcoin’s post-halving volatility advantage. The halving-induced supply shock created price fluctuations that systematic investing exploited perfectly. When prices dipped in early 2025 to around $85,400 during a typical mid-cycle correction, the fixed ₹1,000 investment bought more Bitcoin units at reduced prices, significantly improving the average purchase price and positioning the portfolio for substantial gains as the halving cycle matured.

Nifty 50 SIP Performance During Bitcoin’s Halving Cycle

The Nifty 50 investment told a contrasting story of stability and modest growth during the same post-halving period. Beginning at 22,150 points in April 2024, the index experienced its own set of fluctuations unrelated to Bitcoin’s halving cycle. The same ₹37,000 investment across 37 installments accumulated 1.536035 Nifty units through index funds, with an average purchase price of ₹24,087.99 per unit.

By October 2025, with Nifty trading at 24,894, the portfolio value reached ₹38,238. The absolute gain of ₹1,238 translated to a return of just 3.35 percent before taxation. While these numbers might seem disappointing compared to Bitcoin’s post-halving performance, they reflect the reality of equity market performance during a consolidation phase that coincided with Bitcoin’s bullish halving cycle.

The Nifty journey showed several attempts to break higher levels, reaching peaks around 25,940 in October 2024, before retreating during global market uncertainties in early 2025. Unlike Bitcoin’s halving-driven trajectory, the index struggled to maintain momentum, spending months in a sideways range that limited returns for systematic investors.

The Tax Reality for Indian Investors

This is where the comparison takes a dramatic turn. India’s tax regulations treat cryptocurrency and equity investments vastly differently, and these differences significantly impact your actual take-home returns from the post-halving Bitcoin gains.

For cryptocurrency investments, the government imposes a flat 30 percent tax on gains, regardless of how long you hold the asset through the halving cycle. There’s no indexation benefit, no loss offset against other income, and an additional one percent TDS gets deducted on transactions exceeding certain thresholds. On the Bitcoin investment with ₹17,374 in post-halving gains, the tax liability amounts to ₹5,212.

For Nifty 50 index fund investments held beyond 12 months, long-term capital gains tax applies at 12.5 percent on gains exceeding ₹1.25 lakh per financial year. Since the Nifty investment gain of ₹1,238 falls well below this threshold, no tax applies on these gains, making the entire amount tax-free for this investment period.

Post-Tax Performance Comparison in the Halving Era

After accounting for tax implications, the post-halving financial landscape shifts considerably. The Bitcoin portfolio, after deducting ₹5,212 in taxes from the ₹17,374 gain, delivers a net profit of ₹12,162. Adding this to the original investment of ₹37,000 gives a post-tax portfolio value of ₹49,162. The post-tax return calculates to 32.87 percent, with an annualized post-tax return of approximately 21.07 percent, still reflecting the powerful impact of investing during the post-halving cycle.

The Nifty 50 investment enjoys the full benefit of its ₹1,238 gain since it remains below the exemption threshold. The post-tax portfolio value stays at ₹38,238, maintaining its 3.35 percent return completely intact.

Even after the substantial 30 percent tax hit, Bitcoin’s post-halving performance still outperforms Nifty 50 significantly. The post-tax outperformance stands at 29.52 percentage points, which is 8.83 times better than Nifty returns. Every ₹1,000 invested in Bitcoin post-halving becomes ₹1,329 after tax, compared to ₹1,033 in Nifty. The extra post-tax gain from choosing Bitcoin over Nifty amounts to ₹10,924 on a ₹37,000 investment.

Understanding Halving Cycle Stages

Bitcoin halving cycles typically follow predictable patterns across four distinct phases. The pre-halving accumulation phase sees smart money entering positions anticipating the event. The immediate post-halving consolidation phase, which this analysis captures, often shows volatility as markets digest the supply shock. The subsequent parabolic phase typically sees exponential price growth, followed by an eventual correction phase before the next halving cycle begins.

This 18-month analysis captures the early-to-mid post-halving phase, historically one of the most profitable periods for systematic investors. Understanding where we are in the halving cycle helps investors make informed decisions about position sizing and risk management during different market phases.

Risk-Adjusted Returns Analysis Post-Halving

While Bitcoin maintains its performance lead even after taxation during the post-halving period, the risk profile remains substantially higher. The cryptocurrency experienced multiple corrections characteristic of halving cycles, with portfolio values dropping significantly below invested amounts during volatile periods. The 30 percent tax bite also means you need even stronger gains just to break even compared to tax-efficient equity investments.

Nifty 50 delivered stability with complete tax efficiency for smaller gains. For investors in lower tax brackets or those with smaller portfolios, this tax advantage becomes increasingly meaningful. The psychological comfort of minimal volatility combined with tax-free gains makes traditional equity indices attractive despite lower absolute returns compared to Bitcoin’s post-halving surge.

Strategic Portfolio Allocation During Halving Cycles

When both SIPs run simultaneously with ₹1,000 each during the post-halving period, the total investment of ₹74,000 grows to ₹87,400 after tax. The combined post-tax gain stands at ₹13,400, representing a blended return of 18.11 percent. This demonstrates how diversification maintains attractive returns while managing both market risk and tax efficiency during Bitcoin’s volatile halving cycles.

A strategic allocation becomes even more critical when considering tax implications and halving cycle timing. Allocating 70 percent to Nifty and 30 percent to Bitcoin creates a portfolio that balances growth potential, volatility management, and tax optimization. The Nifty component provides stability and tax efficiency, while the Bitcoin allocation captures high-growth opportunities during the post-halving cycle despite heavier taxation.

Timing Your Entry in the Halving Cycle

Starting a Bitcoin SIP immediately post-halving, as this analysis demonstrates, captures the full benefit of the subsequent bull cycle. Historical data from previous halving events in 2012, 2016, and 2020 shows that systematic investment beginning in the months following halving consistently outperforms lump-sum investments made during pre-halving peaks.

The beauty of SIP during post-halving periods lies in capturing both the initial consolidation phase at reasonable prices and the subsequent rally phase without trying to time the market perfectly. This approach worked exceptionally well in this 18-month period, with early investments buying at lower post-halving prices while later installments participated in the upward momentum.

Halving Supply Shock and Price Impact

The halving event’s reduction in new Bitcoin supply from 900 to 450 BTC daily creates a fundamental supply-demand imbalance that drives long-term price appreciation. With institutional demand for Bitcoin increasing through spot ETFs and corporate treasury adoption, the reduced supply entering circulation naturally pushes prices higher over time.

This supply shock effect typically takes 6 to 12 months to fully manifest in prices as existing inventory gets absorbed and buyers compete for scarcer new supply. The 18-month period analyzed here captures this supply shock impact, with prices nearly doubling from post-halving levels as the market adjusted to reduced daily issuance.

Practical Investment Framework for Halving Cycles

For young professionals with 15 to 20 year investment horizons spanning multiple halving cycles, allocating 20 to 25 percent to cryptocurrency through systematic plans makes sense despite tax disadvantages. The potential for outsized returns during post-halving periods justifies the tax cost when building long-term wealth across multiple four-year cycles.

Conservative investors or those nearing retirement should maintain cryptocurrency exposure below 10 percent of their portfolio even during attractive post-halving phases. The combination of high volatility and unfavorable taxation makes large cryptocurrency allocations risky for those who cannot afford significant losses or have shorter investment timelines that might not span full halving cycles.

Middle-income investors must calculate whether cryptocurrency’s higher pre-tax returns during post-halving periods justify the 30 percent tax hit compared to tax-efficient equity alternatives. For smaller portfolios under ₹10 lakh, maximizing tax-free equity gains through index funds often proves more beneficial than chasing cryptocurrency returns that face heavy taxation.

Historical Halving Performance Context

The 2024 halving represents Bitcoin’s fourth such event, with each previous halving followed by substantial price appreciation. The 2012 halving saw Bitcoin rise from $12 to over $1,100 within 18 months. The 2016 halving preceded a rally from $650 to $19,000. The 2020 halving sparked a surge from $8,800 to $69,000.

This historical context suggests that the current post-2024 halving cycle might still have significant upside potential beyond the 18-month period analyzed here. Investors entering systematic plans now continue benefiting from the halving cycle’s remaining duration, potentially amplifying returns as the cycle matures toward its eventual peak.

Long-Term Tax Efficiency Across Multiple Halving Cycles

Over extended periods spanning multiple four-year halving cycles, the tax differential between cryptocurrency and equity investments compounds significantly. A 10-year systematic investment covering two complete halving cycles and facing 30 percent annual taxation on cryptocurrency gains versus 12.5 percent on equity gains above ₹1.25 lakh creates substantial wealth differences even when pre-tax returns favor cryptocurrency during post-halving surges.

However, the exponential nature of post-halving price appreciation historically compensates for the tax disadvantage when measured across full cycles. Strategic wealth management across multiple halving cycles requires balancing immediate post-halving return potential against long-term tax efficiency to maximize post-tax wealth accumulation.

Final Thought

The 18-month post-halving tax-adjusted comparison between Bitcoin and Nifty 50 SIPs reveals that cryptocurrency investment during halving cycles remains attractive despite India’s heavy taxation. Bitcoin delivered 32.87 percent post-tax returns compared to Nifty’s 3.35 percent, proving that systematic cryptocurrency investment timed with halving cycles can generate substantial wealth even after the 30 percent tax bite. The halving-induced supply shock created precisely the market conditions where systematic investing excels, capturing volatility while building positions throughout the post-halving accumulation and early bull phase.

Smart investors recognize that successful wealth creation requires understanding both Bitcoin’s four-year halving cycles and post-tax realities. Understanding this concept of dollar-cost averaging, I recently started a crypto SIP in top 10 coins with a long-term view, expecting good returns. Whether you choose cryptocurrency, equity indices, or a balanced combination, factor in both halving cycle timing and taxation from day one of your investment planning. This is educational content, not financial advice, so always do your own research. The power of systematic investing combined with halving cycle awareness and tax-conscious portfolio construction creates the optimal path to long-term financial success in India’s evolving investment landscape.

External Links:

Cryptocurrency Prices, Charts And Market Capitalizations | CoinMarketCap

Frequently Asked Questions

What is Bitcoin halving and why does it matter for investors?

Bitcoin halving reduces mining rewards by half every four years, cutting new supply from 900 to 450 BTC daily. This supply shock historically triggers substantial price appreciation, making post-halving periods attractive for systematic investment.

When was the last Bitcoin halving event?

The fourth Bitcoin halving occurred in April 2024, reducing block rewards from 6.25 to 3.125 BTC. The next halving is expected around 2028, continuing the four-year cycle embedded in Bitcoin’s protocol.

What is the actual tax on Bitcoin profits post-halving in India?

Bitcoin and all cryptocurrency profits face 30 percent flat tax regardless of holding period or halving cycle timing, with no indexation benefits or loss offsets. Additionally, one percent TDS applies on crypto transactions exceeding specified thresholds.

Should I start Bitcoin SIP after halving events?

Yes, historical data shows post-halving periods offer optimal entry timing for systematic investors. Starting SIP immediately after halving captures the full bull cycle while rupee cost averaging manages volatility throughout the accumulation phase.

How long does post-halving Bitcoin rally typically last?

Post-halving rallies historically last 12 to 18 months before reaching cycle peaks, followed by correction phases. The 2024 halving cycle follows similar patterns, with significant appreciation potential remaining beyond the current 18-month analysis period.

Are Nifty 50 returns affected by Bitcoin halving cycles?

No, Nifty 50 performance operates independently from Bitcoin halving cycles, driven by corporate earnings, economic conditions, and domestic factors. However, global liquidity conditions influenced by crypto cycles can indirectly impact equity markets.

Can I reduce tax on cryptocurrency gains from post-halving profits?

Legal tax reduction options are limited due to flat 30 percent rate with no exemptions. Spreading withdrawals across financial years and timing sales strategically provides minimal benefit compared to tax-efficient equity investments.

Which investment is better after tax during halving cycles: Bitcoin or Nifty?

Bitcoin delivered 32.87 percent post-tax returns versus Nifty’s 3.35 percent during this post-halving period. However, individual circumstances, risk tolerance, and understanding of four-year halving cycles determine optimal allocation between both assets.

Leave a Reply